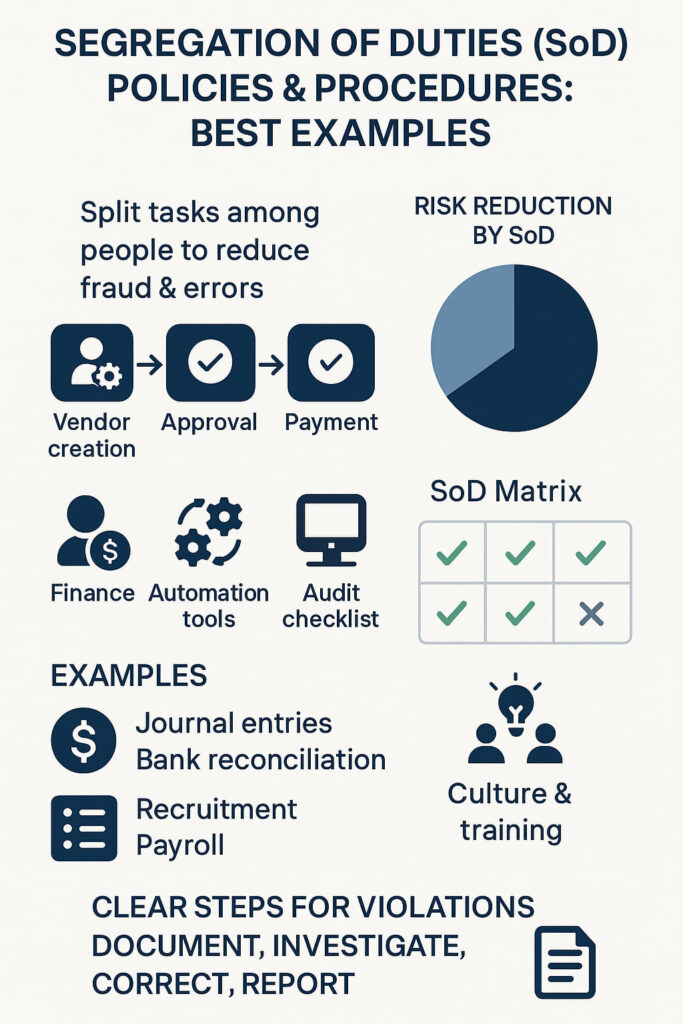

Nobody likes rules until they save your neck. Segregation of Duties sounds fancy, but it’s really just common sense – don’t let one person control everything. Like how you wouldn’t want your teenage kid to both write and cash their own allowance checks. Companies use these policies to split up tasks between different people, especially when money’s involved.

Think of it as a built-in buddy system: one person creates a vendor account, another one checks it, and someone else handles the payments. Smart businesses know this stuff prevents both honest mistakes and not-so-honest schemes. Want to see how this actually works in real life? Let’s look at some examples.

Key Takeaways

- SOD policies split critical tasks among multiple people to reduce fraud risks and errors.

- Procedures include managing user access, regular audits, and using automation to enforce rules.

- Examples show how finance, HR, and IT departments separate roles to maintain control and compliance.

What Are Segregation of Duties Policies?

No company wants their money walking out the door because someone had too much control. That’s where segregation of duties comes in – it’s really just common sense dressed up in business clothes. Think of it like this: you wouldn’t want the same person who writes the checks to also sign them, right?

Breaking down tasks between different people isn’t just about trust, it’s about protecting everyone involved. When someone’s got their hands in every part of a process (like handling both the money and the books), things can go sideways fast.

Most fraud cases happen because someone had too much freedom to move things around without anyone checking, a trend highlighted in global fraud surveys showing weak oversight as a leading cause of financial loss [1]. Here’s what these policies usually cover:

- Job descriptions with crystal-clear boundaries (so Bob from accounting knows exactly what he can and can’t do)

- A “no-no” list of jobs that can’t be done by the same person (like approving expenses and processing payments)

- Step-by-step approval processes that need multiple people to sign off

- What to do when someone breaks the rules (because it’s gonna happen)

- Regular check-ups to make sure everything’s running right

Sometimes it feels like a pain, especially in smaller companies where everyone wears multiple hats. But without these guardrails, it’s like leaving the bank vault door wide open. The trick is finding that sweet spot between tight controls and getting work done efficiently.

These policies aren’t perfect – nothing is – but they’re like having a good insurance policy. You hope you never need it, but you’re really glad it’s there when something goes wrong.

Remember, it’s not about not trusting people. It’s about creating a system where honest mistakes get caught early, and the not-so-honest ones don’t have a chance to take root.

Why Splitting Roles Matters

Small business owners juggle enough balls without worrying about someone cooking the books. It’s a tough spot when Sarah’s handling both the checkbook and making sure everything matches up with the bank statements. Sure, she’s probably honest – most people are – but that’s not really the point.

Here’s the thing about having one person do it all: mistakes happen. Maybe it’s just a typo, maybe it’s someone trying to cover their tracks after “borrowing” from the till. Who’s gonna catch it? Nobody, that’s who. When the same person’s writing checks and checking their own work, it’s like grading your own test paper.

Picture this: The office manager approves a $5,000 payment to a vendor. Seems normal enough. But what if that vendor doesn’t exist? If they’re also the one reconciling the bank statements, they could hide that fake payment pretty easily.

Split these jobs between two people, though, and suddenly that fake vendor better have some really good paperwork. The fix isn’t complicated. Have one person handle the money going out, and another check the books. Simple as that. It doesn’t mean anyone’s not trustworthy – it’s just smart business. Like having two locks on your front door instead of one.

Yeah, it takes an extra key, but you sleep better at night. Most small business owners don’t think about this stuff until something goes wrong. By then, they’re usually out thousands of dollars and wondering how they missed it. A little paranoia upfront saves a lot of heartache later. Plus, it’s just good business sense – kinda like not putting all your eggs in one basket, except these eggs are made of money.

Putting Policies into Practice: Procedures That Work

Policies are only as good as how they get enforced. That’s where procedures kick in,real steps organizations take day to day to make sure policies aren’t just words on paper.

Managing User Access

Access management is pivotal. Permissions must match defined roles strictly. For example, only the finance team gets access to payment systems; sales don’t. Teams handling access provisioning grant permissions aligned to job roles. Another team regularly reviews these permissions to adjust or remove access if someone changes roles or leaves.

This two-team system helps prevent conflicts like one person gaining too many privileges, and it connects directly to how implementing separation of duties SOD strengthens accountability across departments.

Using Automation and Technology

Manual controls can’t always catch every slip. Automated systems are increasingly used to detect and block SoD conflicts. They log every access request, flag risks, and enforce rules automatically. Some Identity Governance and Access (IGA) tools can even revoke risky permissions proactively.

Building effective sod policies procedures examples in IT often relies on this automation layer to close gaps before they turn into bigger risks.

Regular Audits and Continuous Monitoring

Scheduled reviews and audits keep the process honest, with research showing that periodic oversight is one of the strongest defenses against hidden conflicts [2]. They look for violations or gaps. When conflicts pop up, organizations follow a documented resolution path, often involving revoking access, retraining staff, or escalating to management.

In practice, these steps highlight the real benefits of separation duties controls by ensuring checks and balances remain active even as teams grow and systems evolve.

Handling Exceptions

Small organizations might struggle with perfect segregation due to limited staff. They implement compensating controls like increased supervision or frequent reviews to reduce risks where strict separation isn’t feasible.

Real-World Examples of SOD Policies and Procedures

Source: NCURA1959

Seeing how SOD policies play out in various departments helps clarify their value.

Financial Controls

- Journal Entries: The person who approves a journal entry is not the one posting it.

- Bank Reconciliation and Vendor Payments: Different individuals handle these tasks to prevent fraud.

- Transaction Workflow: Initiation, approval, and recording are split among separate people.

These rules ensure no individual can cover up unauthorized transactions.

Human Resources

- Recruitment: Posting jobs, screening candidates, and interviewing are done by different staff.

- Payroll vs. Benefits: One team handles payroll processing, while another manages benefits.

- Employee Records: Those responsible for managing records are separate from decision-makers to protect sensitive information.

This segmentation reduces bias and fraud risks in hiring and compensation.

IT and Security

- Access Requests: The person requesting access cannot approve it.

- Privileged Account Management: Administrators and auditors have distinct roles.

- Automation Checks: Systems enforce SoD rules automatically to prevent conflicts before they happen.

This prevents unauthorized access and strengthens security.

Building and Using SOD Matrices

A small but growing number of companies won’t stop talking about SOD matrices these days, and there’s a good reason why. These visual maps show who should (and shouldn’t) have access to do certain things in a system – kind of like a seating chart that keeps troublemakers apart in class.

Think of it this way: you probably don’t want the same person who writes checks to also approve them. That’s where these matrices come in handy. They lay out all the jobs people do and mark which ones clash, usually with a simple X or checkmark in each box where duties shouldn’t mix.

Most managers find these matrices pretty useful when they’re figuring out who gets what access. Instead of playing guesswork, they’ve got a clear blueprint right in front of them. Plus, when those dreaded auditors show up (and they always do), there’s solid proof that someone thought this through.

Every few months, someone needs to dust off these matrices and make sure they still make sense. People change jobs, new systems pop up, and what worked six months ago might not cut it anymore. It’s a bit like spring cleaning – nobody loves doing it, but it keeps things from getting messy.

Creating a Culture That Upholds SOD

Policies and procedures won’t work if ignored. Training employees on the importance of segregation of duties and how to follow procedures fosters awareness. When team members understand the risks of SOD violations,like fraud or data breaches,they’re more likely to comply.

What to Do When SOD Violations Occur

Despite best efforts, violations happen. Having a clear incident response process is crucial. This includes:

- Documenting violations promptly.

- Investigating causes.

- Correcting access or roles.

- Reporting to management.

- Adjusting policies or training to prevent repeats.

FAQ

How do sod policies and procedures help prevent risks in an erp system?

Sod policies and a clear duty policy reduce the risk of fraud, errors, and conflicts of interest by separating roles and responsibilities. Within an erp system, access control and user access reviews provide compliant access and secure access.

Regular access reviews, review processes, and strong internal controls help prevent unauthorized access, manage access privileges, and maintain compliance. Following best practices in sod compliance, sod principles, and a structured sod framework ensures effective checks and balances.

These steps help prevent sod conflicts, reduce the risk, and strengthen security and compliance across business processes, financial records, and vendor management.

Why is a separation of duties policy important for risk management?

A separation of duties policy ensures that no single individual or employee has complete control over critical business processes. Segregating duties across multiple individuals minimizes the risk of unauthorized access, fraudulent activities, and compliance violations.

Strong internal controls, accurate financial reporting, and well-defined access provisioning depend on assigning distinct roles. This separation ensures robust security, reduces the risk of personal gain, and mitigates potential risks from financial misconduct.

Clearly defined organizational roles, tasks, and responsibilities establish a system of checks and balances that helps prevent potential sod conflicts and ensures ongoing compliance.

What role do access management and user access review play in sod compliance?

Access management ensures that access is properly aligned with authorization roles, employees’ access rights, and access patterns. Regular user access reviews, including periodic user access reviews and a thorough access review process, identify potential sod violations, sod conflicts, and risks of unauthorized access.

Access provisioning, access permissions, and structured access request management allow organizations to maintain compliance with sod rules. Conducting periodic user access reviews in real time reduces the risk of data breaches and security breaches.

This proactive approach helps prevent unauthorized access, reduces the risk of fraud, and supports operational efficiency across critical business processes.

How does a segregation of duties policy support financial processes and regulatory compliance?

A segregation of duties policy ensures the integrity of financial records, recording transactions, and reconciling bank statements. Separation ensures that no single user gains complete control over financial transactions, financial statements, or bank statements.

Effective financial management and oversight of financial activities rely on internal controls, comprehensive reporting, and accurate financial reporting to minimize errors and fraud. Regulatory compliance, compliance readiness, and compliance efforts require clear policies and procedures to reduce the risk of unauthorized access.

This systematic approach ensures that regulatory requirements are met while reducing the risk of compliance violations and maintaining the integrity of financial processes.

Conclusion

Nobody likes rules until they save your neck. Segregation of Duties sounds fancy, but it’s really just common sense – don’t let one person control everything. Like how you wouldn’t want your teenage kid to both write and cash their own allowance checks.

Companies use these policies to split up tasks between different people, especially when money’s involved. Think of it as a built-in buddy system that catches both honest mistakes and not-so-honest schemes. Want to learn the right way to implement these controls? Check out the Secure Coding Practices Bootcamp.

References

- https://www.acfe.com/fraud-resources/report-to-the-nations-archive

- https://www.deloitte.com/ng/en/services/audit/perspectives/coso-control-activities.html