Internal audits can feel like a chore, but separating duties is a real game-changer in fraud prevention. Our team at the training bootcamp sees this firsthand – when one person handles too many financial tasks, mistakes pop up and fraud risks soar. We’ve watched companies learn this lesson the hard way. Picture this: A bookkeeper who both writes checks and reconciles bank statements.

Seems efficient, right? Yet that setup burned several startups we’ve trained. Their financial controls crumbled within months. Think your company has solid SoD practices? Maybe, but there’s always room for improvement. Let’s explore what makes effective duty separation work.

Key Takeaway

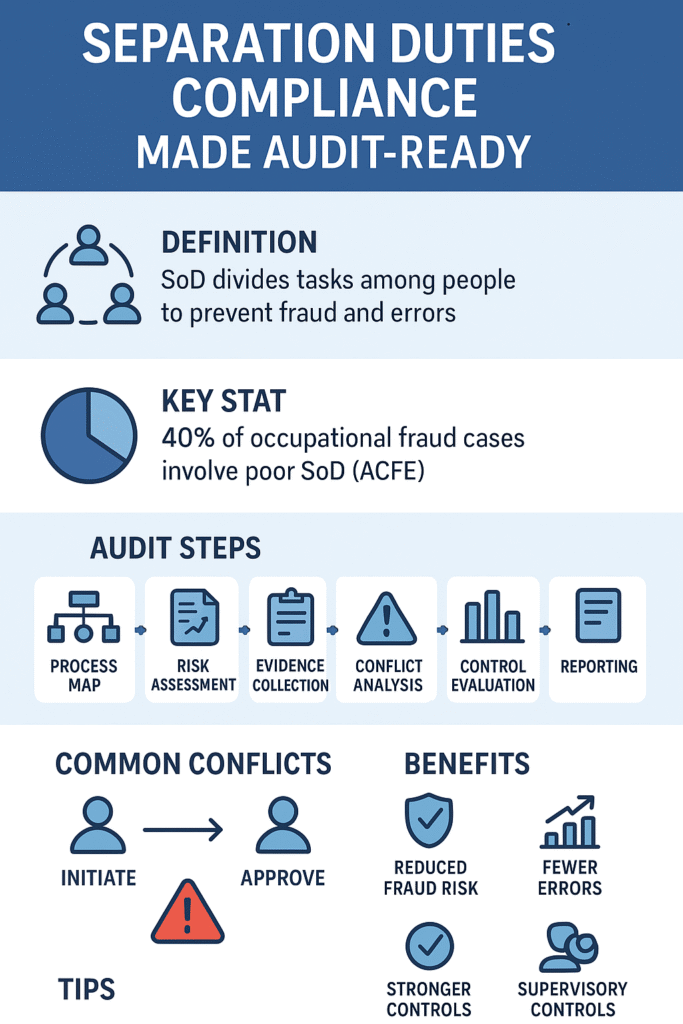

- Separation of duties divides critical tasks among different people to prevent fraud and errors.

- Auditing SoD compliance involves reviewing policies, access rights, transaction testing, and control assessments.

- Detecting and fixing SoD conflicts strengthens internal controls and supports regulatory compliance.

The High Cost of Poor SoD: Why It Matters

Fraud and errors often trace back to weak or missing segregation controls in an organization. Think about it: If one person can initiate, approve, and reconcile a financial transaction, the opportunity for abuse or mistakes skyrockets. Audits often find instances where a single employee controls multiple stages such as vendor payments, increasing fraud risk significantly. Within months, millions disappeared, and the audit trail was murky at best. This wasn’t just a fluke, it’s a classic example of how ignored SoD compliance invites trouble.

Industry data backs this up. According to the Association of Certified Fraud Examiners (ACFE), inadequate separation of duties contributes to nearly 40% of occupational fraud cases. Errors, too, tend to slip through when controls fail, causing operational risks and impacting financial reporting accuracy. SoD is more than a checkbox; it’s a critical safeguard.

What is Separation of Duties (SoD)?

Separation of duties in development means dividing responsibilities so that no one person controls all parts of a transaction or process. The principle is simple yet powerful: by splitting tasks like transaction approval, asset custody, and reconciliation among multiple people, organizations reduce chances of fraud and error. We’ve seen how separation of duties controls can create natural checks and balances that catch problems early and protect key assets.

Most security breaches aren’t sophisticated hacks, they’re just people with too much access doing things they shouldn’t. Our training sessions always circle back to three main ways to helps: Makes sure nobody’s judge and jury of their own work, Forces multiple people to sign off on big changes, Keeps everyone honest by splitting up the power.

We’ve seen SoD applied across many areas, finance, procurement, IT access management, and even vendor payments. For example, the person who approves a payment shouldn’t be the same person who creates the vendor account or reconciles the bank statements. This way, if something shady happens, it’s much easier to detect and trace.

The core principles include:

- Assigning different user roles to critical tasks

- Enforcing role-based access controls

- Maintaining audit trails and transaction logs for transparency

- Implementing supervisory and independent reviews

TL;DR: Key Aspects of SoD Compliance

Here’s a quick snapshot of what an SoD audit typically covers:

| Aspect | Description |

| Policy & Procedures | Documented roles, segregation rules, and procedures. |

| Access Reviews | User access rights in systems and physical controls. |

| Transaction Testing | Verifying transactions were processed with proper segregation. |

| Exception Handling | Identifying and addressing SoD conflicts with compensating controls. |

| Control Evaluation | Assessing the effectiveness of compensating controls. |

SoD Audit Process: Step-by-Step

Credit: Edspira

1. Understand the Process

Before diving into numbers or logs, you need to get a clear picture of how the process flows and who does what. We usually start by reviewing process flowcharts and role descriptions. Visualizing the workflow helps spot where duties might overlap.

Think of a payment process. Someone initiates the payment request. Another person approves it. Yet another reconciles the vendor account. If these roles aren’t clearly assigned or documented, red flags pop up.

Actionable Tip: Map your key processes early on to catch potential SoD conflicts.

2. Identify Risks

Not all processes carry the same risk. High-value transactions or sensitive systems demand stricter segregation. We often approach this by conducting a risk assessment that highlights where SoD gaps could cause the most damage.

Consider SoD risks as cracks in a dam , some cracks are small, others could lead to a flood if ignored.

Actionable Tip: Prioritize your audit efforts based on risk level.

3. Collect Evidence

Next comes gathering evidence , user roles, system access logs, transaction samples, and audit trails. We’ve found that automated tools are lifesavers here, especially when dealing with thousands of transactions and users.

Access logs reveal who has permissions that might conflict with their job responsibilities. Transaction samples allow you to validate if approvals and reconciliations were properly done.

Short Example: We uncovered a case where several users had both payment initiation and approval rights, a clear SoD violation.

4. Analyze Conflicts

This is where you detect SoD conflicts, either through software or manual reviews. Focus on common conflict scenarios that pose the highest fraud risk.

Common conflicts include:

- One person initiates and approves payments

- Same employee creates and reconciles vendor accounts

- Unsegregated access to financial systems

Actionable Tip: Pay special attention to high-risk areas and recurring conflict patterns.

5. Evaluate Controls

Sometimes complete segregation isn’t possible. That’s where compensating controls come in , like supervisory reviews or automated alerts. But these controls must be documented and tested regularly to ensure effectiveness.

We often check if compensating controls cover the risk gap and whether they operate consistently.

Actionable Tip: Don’t assume compensating controls work; verify them.

6. Report Findings

Finally, document what you find. This includes detailing the SoD conflicts, their potential impact, and recommendations for fixing them. Prioritize issues based on severity, focusing on those that threaten financial integrity or compliance.

Clear audit documentation helps management understand risks and take action.

Actionable Tip: Use concrete examples and link findings to business risks for stronger impact.

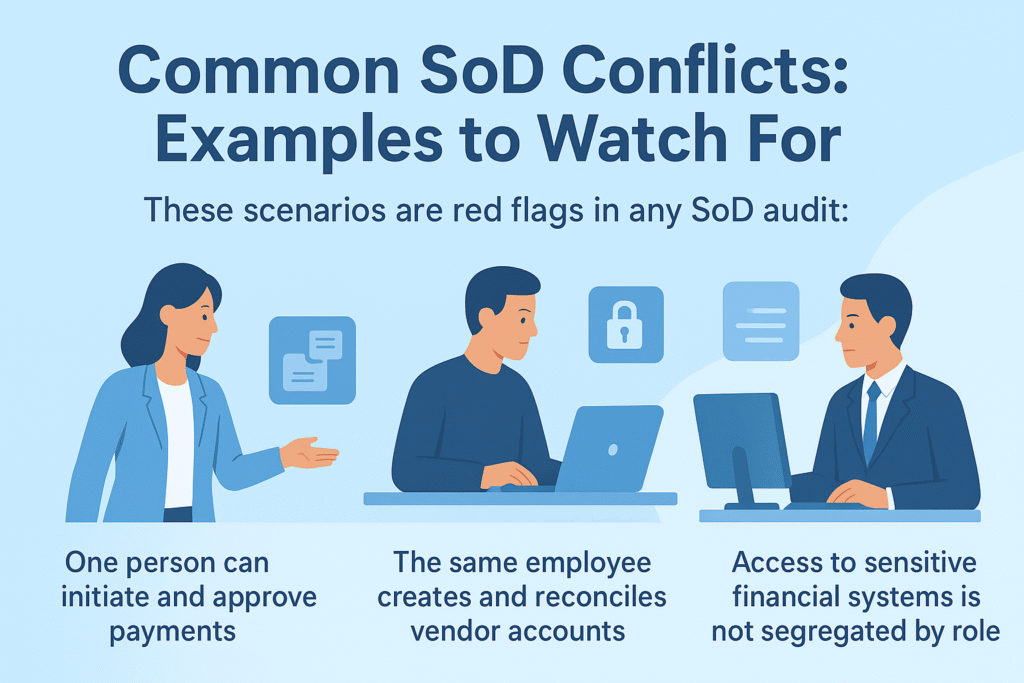

Common SoD Conflicts: Examples to Watch For

These scenarios are red flags in any SoD audit:

- One person can initiate and approve payments

- The same employee creates and reconciles vendor accounts

- Access to sensitive financial systems is not segregated by role

We encounter these issues more often than you’d think. Sometimes it’s due to lack of policy enforcement, other times due to system access control weaknesses.

Benefits of a Robust SoD Audit

According to a study by Alvarez & Marsal (2023), companies that implement structured segregation of duties frameworks reduce internal fraud incidents by up to 30% and significantly improve audit transparency and operational reliability. This reinforces that SoD isn’t just about compliance — it’s about protecting reputation, performance, and trust. (1)

When SoD compliance is audited and enforced effectively, organizations see clear benefits: Internal control studies by Pathlock reveal that inadequate segregation of duties remains one of the top root causes of material control weaknesses, emphasizing the ongoing need for continuous monitoring and policy enforcement. (2)

From our audits, companies that invest in SoD controls experience fewer control failures and smoother financial audits. It’s not just about compliance; it’s about protecting your organization’s reputation and assets.

Strengthening Your Audit Separation Duties Compliance Approach

Ensuring SoD compliance requires more than a one-time check. It’s an ongoing process of monitoring activities, reviewing user access, testing transactions, and following up on findings. Our training shows teams exactly how preventing fraud separation duties with layered controls and continuous oversight makes a real difference in reducing risk. Embedding this into your audit framework improves control design and reduces compliance risks over time.

A comprehensive SoD audit involves:

- Regular user access reviews to prevent unauthorized system access

- Transaction authorization checks to confirm proper segregation

- Reconciliation process audits to detect errors or fraud early

- Continuous compliance monitoring and audit follow-up to close control gaps

When our audit teams engage deeply with client processes, we often recommend control improvements tailored to specific risks. Sometimes it means tightening policies, other times enhancing IT controls or adding supervisory steps.

Whatever the approach, the goal remains: keep responsibilities separated enough to prevent conflicts of interest, fraud schemes, and errors that jeopardize financial integrity.

FAQ

What is audit separation duties compliance?

Audit separation duties compliance means dividing key job responsibilities so that no single person controls every step of a financial process. This practice, also called separation of duties or segregation of duties, strengthens internal controls. It supports fraud prevention, error detection, and risk management in areas such as transaction approval, asset custody, and financial reporting.

Why is segregation of duties important in internal controls?

Segregation of duties is essential because it prevents any one person from having complete control over a process. It supports SoD compliance by separating transaction authorization, asset custody, and the reconciliation process. This structure reduces fraud risk, operational risk, and control failures while improving accountability and the overall control environment during a financial audit.

How do auditors test segregation controls and detect issues?

Auditors perform audit testing by reviewing audit trails, transaction logs, and control activities to identify control weaknesses or segregation violations. They also assess IT controls, user roles, and access rights. Through audit documentation and independent review, auditors verify that compensating controls and process controls are effective for risk mitigation and compliance audit accuracy.

What happens if control gaps or duty conflicts are found?

If audit findings reveal duty conflicts, control gaps, or control weaknesses, the internal audit team recommends control improvements. They may adjust responsibilities segregation, strengthen policy enforcement, or add compensating controls. These steps reduce fraud risk, improve control effectiveness, and protect financial integrity through continued compliance monitoring and audit follow-up.

How can organizations maintain strong segregation of duties over time?

Organizations can maintain effective segregation of duties through regular user access review, transaction review, and supervisory review. They should conduct risk assessment and audit planning to detect compliance risks early. Following an established audit framework, audit checklist, and consistent monitoring activities helps maintain control policies and support ongoing compliance validation.

Conclusion

Auditing separation of duties (SoD) compliance isn’t just a technical exercise, it’s a practical way to strengthen financial controls and reduce liability. By understanding the process, identifying risks, gathering solid evidence, and carefully evaluating controls, auditors and organizations can work together to create a safer, more reliable control environment.

If you’re serious about protecting your company from fraud and ensuring accurate financial reporting, make auditing SoD compliance part of your routine. Join the Secure Coding Practices Bootcamp to deepen your team’s understanding of secure systems, risk management, and practical compliance, so your organization stays resilient from code to control.

References

- https://www.alvarezandmarsal.com/printpdf/82826–en

- https://pathlock.com/learn/4-types-of-internal-controls-weaknesses-and-5-ways-to-fix-them/